Methodology

Project Background

This report synthesizes the extensive findings of a yearlong analysis of the experiences, preferences, assumptions and barriers relating to work and workers in the wake of the Covid-19 pandemic led by the Fund for Our Economic Future and other partners across Northeast Ohio.

More than 5,000 residents and 600 employers across the region participated in surveys and focus groups from December 2021 – July 2022. Their responses produced a significant volume of data that serves as both a historical record of the experiences of Northeast Ohioans in the early years of the Covid-19 pandemic and an abundance of potential implications and actionable findings for employers, workforce development leaders, philanthropists, policymakers and others.

Through “Where Are the Workers?”, the Fund for Our Economic Future and partners shared emerging insights through community presentations and online throughout 2022 and continued to conduct analysis to understand what matters for workers and for equitable growth beyond the early years of the pandemic.

Strengthening Workplaces was published in December 2022 to provide an accessible “front door” to these findings—a cross-section of notable takeaways and trends to orient readers to this research, generate discussion and prompt deeper engagement with the factors influencing today’s workers.

The methodology for collection, analysis and synthesis of data through these efforts is presented in detail below.

Project timeline

National scan of existing research

Soon after the Where Are the Workers project team convened, the Fund for Our Economic Future conducted a national scan of existing literature to understand what analysis had already been conducted on worker shortages.

Employer survey

From mid-December 2021 to January 2022, The Corporate University at Kent State University Stark administered a survey of Northeast Ohio employers.

Employer roundtables

Beginning in February 2022, Team NEO hosted roundtable discussions with employers across the region to hear more about their experiences, perspectives and strategies relating to talent.

Survey of Northeast Ohio adults

From February 2022 through April 2022, a market research firm collected survey responses from a demographically representative, statistically significant set of adults living in an 11-county footprint of Northeast Ohio.

Cuyahoga County focus groups

Nearly 70 adult residents of Cuyahoga County participated in six focus groups hosted by community-based organizations in east- and west-side neighborhoods of Cleveland.

Targeted worker focus groups

Additional worker focus groups were held to deepen understanding of particular industries and segments of the workforce.

Data analysis

Additional analysis was conducted beginning May 2022 to identify regional trends, compare segments of workers and residents and inform potential strategies for strengthening workplaces.

Strengthening Workplaces Dashboard Methodology

Worker Segment Definitions

Across the data in the Strengthening Workplaces dashboards, worker segment references are defined as follows:

Children in the home

Survey respondents were asked about whether there were any children in their household, and to indicate the number of children in various age groups. To increase our understanding of how childcare access for children younger than kindergarten impacts workers, we segmented these results into households with no children under 18, households with children between the age of 5-17, and households including children under the age of 5. The charts on Who Left the Workforce and Workforce Participation break these groups of households with children into mutually exclusive groups—households with children ONLY 5-17, and households that include children under 5—while the Pandemic Impact on Earnings chart shows the non-mutually exclusive subset of households with children under 5 as a comparison to overall households with children.

Generations

Survey respondents were asked to indicate the year they were born. For data visualization, respondents were grouped into their associated generation as follows:

- Baby Boomer + – Born before 1965

- Gen X – Born between 1965 – 1979

- Millennial – Born between 1980 – 1996

- Gen Z – Born after 1997

Gender

Survey respondents were asked to indicate whether they identify as a man, a woman, or something else/nonbinary. In most instances, the number of respondents reporting “something else/nonbinary” as their gender identity was insufficient to produce statistically significant results.

Income

Survey respondents were asked to report their total yearly income for their family, before taxes, within the groupings as presented in the charts: Under $25,000; $25,000 – $50,000; $50,000 – $75,000; $75,000 – $100,000, in $25,000 increments up to $250,000. All households reporting greater than $100,000 were grouped together for data visualization.

Industry

Respondents were asked ONLY about the industry in which they are currently employed as their main job. No data was collected on previous industries for workers who retired, are unemployed, left the workforce, or changed industries during a recent job change.

To present comparison data across industry segments, we identified the six industry groupings (identified using NAICS codes) with the largest sample size of respondents. The industry groupings reflect the following sub-categories identified by survey respondents as their current industry employment.

ARTS & ENTERTAINMENT

- Arts & culture

- Entertainment

- Food and beverage

- Hospitality

- Retail

MANUFACTURING

- Manufacturing

- Automotive

- Shipping and receiving

- Transportation

- Maintenance

HEALTHCARE (No subcategories)

PROFESSIONAL SERVICES

- Financial services

- Legal services

- Other professional services

CONSTRUCTION (No subcategories)

EDUCATION (No subcategories)

NONPROFIT/PUBLIC SECTOR

- Nonprofit

- Social services

- Public sector

Race

Survey respondents were to select what race they classify themselves as using the U.S. OMB 1997 Standards for Maintaining, Collecting, and Presenting Federal Data on Race and Ethnicity as used in the United States Census. They were also asked whether they are of Hispanic or Latino origin. In most cases, the number of respondents who reported a racial identity outside other than white or the combined groups of Black/African American and multiracial, as well as Hispanic/Latinx ethnicity, was insufficient to produce statistically significant results.

Methodology for Dashboard Charts

Across the data in the Strengthening Workplaces dashboards, please note the following:

Who Left the Workforce

“Dropped out of the workforce” includes people who stopped working between the start of the pandemic and the time of the survey and were not looking for work, or people who had been out of work since before that time period but had since stopped looking for work. (People who are not working but are actively seeking employment are included in the workforce.)

Barriers to Work

The bar graph shows the percentage of survey respondents within each pre-tax, annual household income segment who indicated that a particular barrier is an “extreme” or “moderate” barrier to employment for themselves or people they know. The five highest rated barriers for each income group are displayed, among the top 11 overall barriers.

Pandemic Impacts on Earnings

“Earning less than before pandemic” indicates the percentage of employed people who had to take a pay cut at some point in the pandemic, and said at the time they were surveyed that their current earnings were either less or “about the same” (accounting for inflation, this indicates reduced earnings) than before they took a pay cut.

“Work interrupted” indicates the percentage of workers who had to stay home (to care for children, older relatives, or due to Covid, respectively) and indicated that the effect of this either caused them to reduce the hours they were able to work, take a leave of absence, or leave their job. Anyone who indicated they had to stay home for these reasons but were able to continue working the same hours was excluded from this graph.

Terminology and Geography

People

The survey instrument included a complex set of question pathways depending on individual responses. (For example, respondents who indicated they retired five years ago were not asked if they quit a job in the previous 12 months.) This analysis has sought to clearly define the subset of respondents to which a particular data point applies, with specific details included wherever possible. Unless otherwise noted, the following definitions are as follows:

- Workers: People currently in the workforce – that is, currently employed, or not employed but seeking employment. This segment does not include respondents who are retired or who are not employed and not seeking employment.

- People: Some questions were asked of all survey respondents, and where these data points are presented, “people” represents adults in the region.

- Respondents: Where a data point applies to a more complex subset of respondents (for example, people who are currently employed and indicate they are somewhat or very likely to quit their jobs in the next 12 months), that subset is described in greater detail within the narrative.

Timing

Surveys and focus groups were administered over a period of several months and included questions asking respondents to consider experiences in certain timeframes, i.e. “the past 12 months.” For the sake of brevity and accuracy, references to time in the Strengthening Workplaces report are as follows:

All references to a specific year refer to approximately March of that year through March of the following year, in alignment with the early pandemic shutdowns and survey timing. (e.g., “2021” is approx. March 2021 – March 2022.)

Elsewhere on wherearetheworkers.com, early findings were published on July 1, 2022 and reference “past year,” “past two years,” “since the pandemic began,” etc. as a point-in-time report on a specific period. These references will eventually be revised to reflect the above, defined years. In the meantime, “the past year” refers to approximately March 2021 – March 2022, “the next year,” e.g., “plan to quit in the next year,” refers to approximately March 2022 – March 2023. “Since the pandemic began” refers to approximately March 2020 – March 2022, etc.

Geography

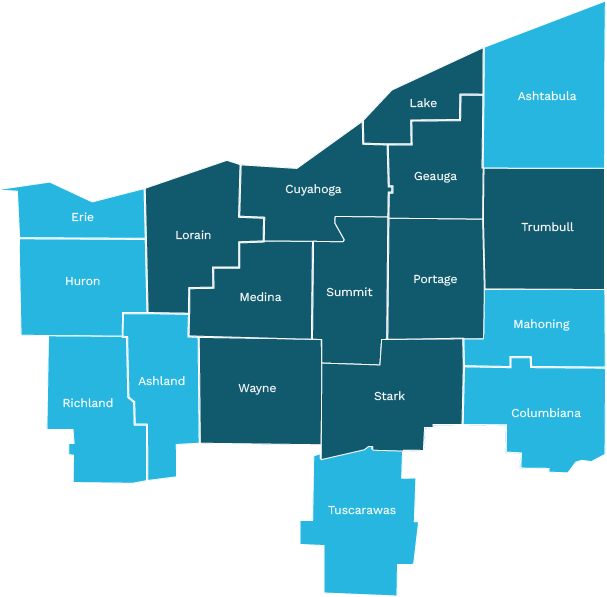

Click the map to enlarge. Employers from the 18 counties of Northeast Ohio participated in the employer survey and roundtables (convenience sample.) A smaller, targeted footprint of the 11 counties shown in darker blue serve as the geographic scope of the Northeast Ohio adult survey and focus groups.

Regional Population Extrapolations

Regional extrapolations using the data from the survey were produced using population data from the 2020 American Community Survey 5-year estimates. These extrapolations are estimates derived by applying survey response data to the population from which the survey sample was drawn and were generated for only those responses that produced statistically relevant results Margins of errors for provided estimates range from 0.437% to 2.412%.

Employer Survey

From mid-December 2021 to January 2022, The Corporate University at Kent State University Stark administered a survey of Northeast Ohio employers. The intent of the survey was to better understand how the labor shortage is manifesting in Northeast Ohio, what employers have tried or are willing to try to attract and retain talent, and how well employers understand what workers want and need in today’s labor market.

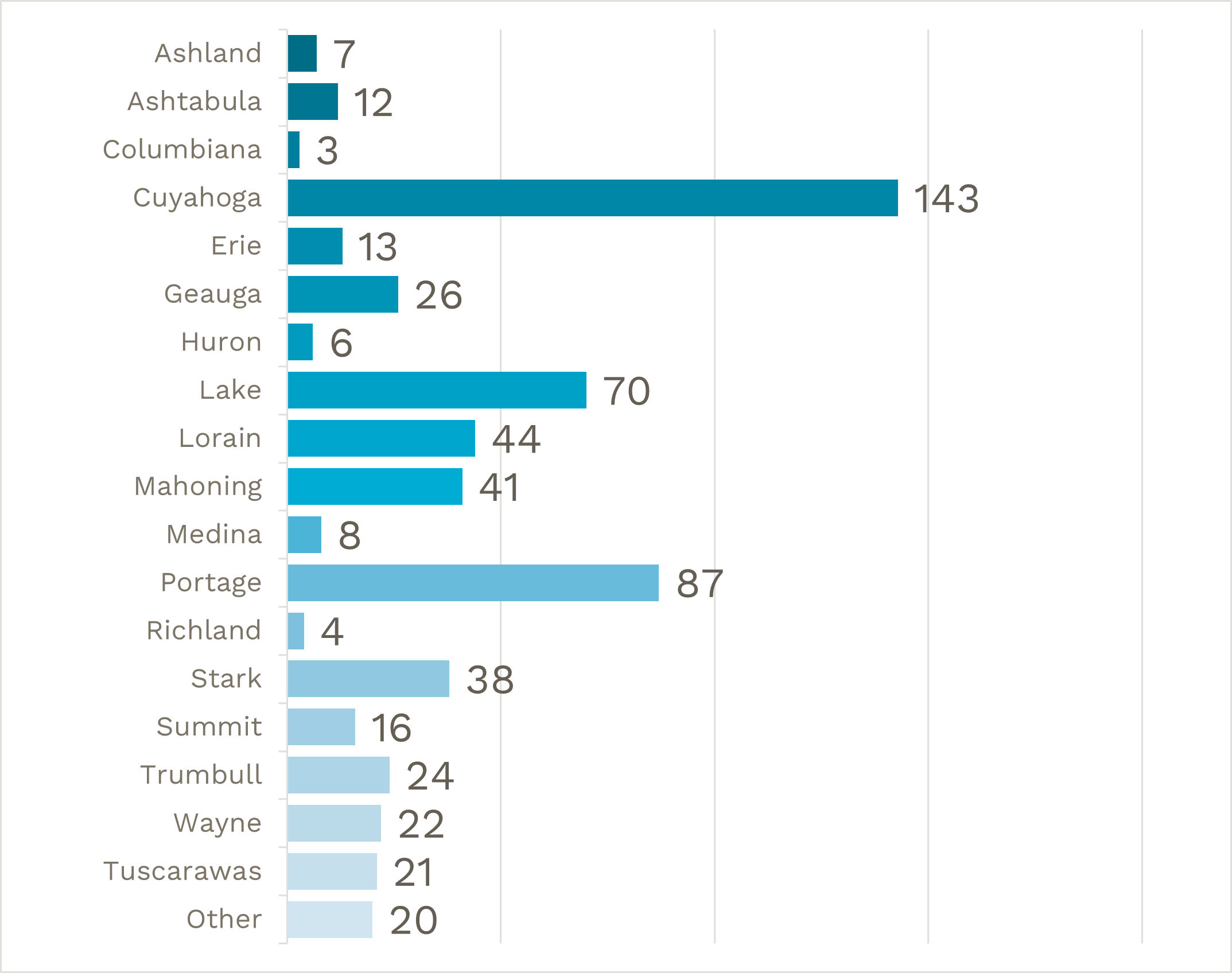

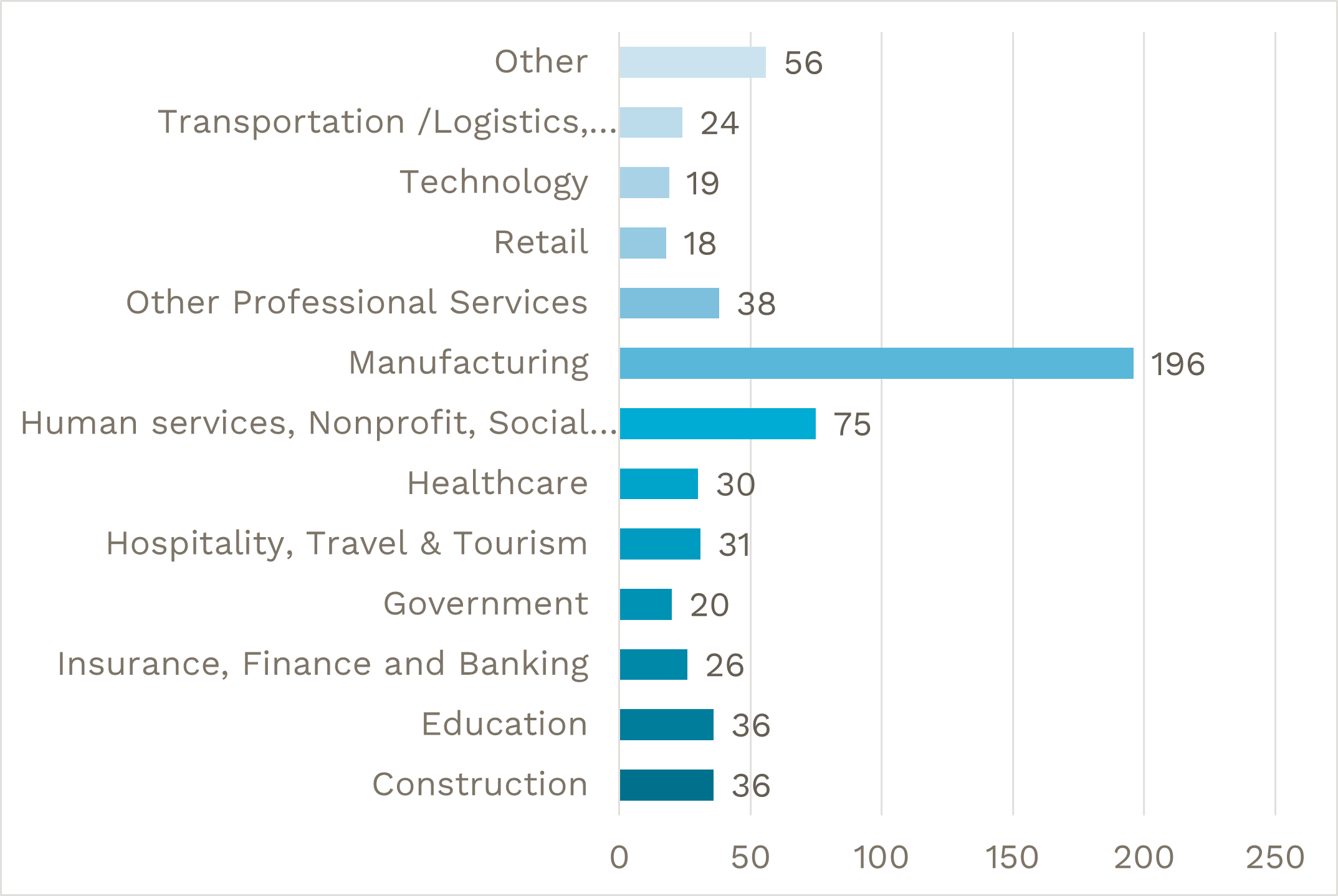

The survey questionnaire was built in the Qualtrics platform with prompts to ensure survey completion. The survey sample of 605 responses was a convenience sample, anonymously collected through a link shared through partner email lists and social media postings. An aggregate report with descriptive statistics and verbatim text of open-ended questions was generated through the Qualtrics platform. Separate aggregate reports for each of the counties were also created. Figure 1 is a breakdown of survey responses received by county and Figure 2 is by industry.

Employer Roundtables

From late January through March 2022, approximately 300 people from 16 counties participated in 23 employer-focused roundtables. Facilitated by Team NEO and PolicyBridge, the roundtables were primarily composed of CEOs, HR directors and managers and business owners, who represented businesses in the manufacturing, health care, information technology, retail, hospitality, banking, trucking and logistics, landscaping, government, and nonprofit/social service sectors.

The purpose of the roundtables was to hear from employers about their attraction and retention challenges and strategies and to dig deeper on themes that emerged from the employer survey.

The roundtables were conducted in partnership with Northeast Ohio economic development, philanthropic and civic organizations (see partner list under Acknowledgements). These organizations helped promote the sessions among their members and constituents and many served as “hosts.” Most of the roundtables were organized by geography, though there were a handful of roundtables that focused on industry or business type (i.e., manufacturing, nonprofit, MBEs). Nearly all the sessions were held virtually; two of the sessions were conducted in-person. Many of those who attended had previously filled out the employer survey.

Every 90-minute session began with an overview of the employer survey data, including any relevant county-specific findings. Though a facilitation guide was developed to help manage the sessions, overwhelmingly, the conversations flowed organically and focused on the particular themes that mattered most to the participants in individual sessions.

The registration process for the sessions captured names, titles and organizations. Industry and demographic information was gleaned from public sources or provided by participants during the sessions.

Read more about the roundtables here.

Working-age Adult Survey

The results of the working-age adult survey are both statistically significant and demographically representative of the geographic area it covered. The Center for Marketing and Opinion Research (CMOR) conducted the 2022 Working-age Adult Survey on behalf of ConxusNEO, in partnership with Ohio’s Local Workforce Area 2 (Summit/Medina Counties) and part of Local Workforce Area 19 (Portage County) as well as the Fund for Our Economic Future. The surveys were conducted between February 10 and May 3, 2022. Respondents in an 11-county area of Northeast Ohio participated in the survey. CMOR collaborated with all partners in the development of the survey instrument.

CMOR administered the survey both online and over the phone. Phone surveys were completed by CMOR’s professionally trained telephone interviewers. Online surveys were conducted utilizing online panels in addition to surveys collected via email invitations sent by CMOR to randomly selected residents of the 11-county region. The design of the online survey was optimized for respondents completing via computer as well as on a mobile device such as a tablet or smartphone. The table below shows sample sizes and margins of error for each county.

For analysis of the region as a whole, weights were added to completed surveys from each county. This allows results to be applied to the entire region with each county being appropriately represented based on their current population. Where analysis of the three-county Greater Akron area are presented, a different set of weights were applied to these three counties to represent this area. Table 2 shows the regional populations and weights applied for the 11-county region as well as the three-county area referenced.

Table 1.

| County | Responses | Margin of Error |

| Cuyahoga | 443 | 4.7% |

| Geauga | 225 | 6.5% |

| Lake | 229 | 6.5% |

| Lorain | 400 | 4.9% |

| Mahoning | 234 | 6.4% |

| Medina | 800 | 3.5% |

| Portage | 800 | 3.5% |

| Stark | 412 | 4.8% |

| Summit | 800 | 3.5% |

| Trumbull | 244 | 6.3% |

| Wayne | 400 | 4.9% |

Table 2.

| COUNTY | POPULATION | POP % | SAMPLE | SAMPLE % | WEIGHT |

| Cuyahoga | 1,241,475 | 33.8% | 443 | 8.9% | 3.81 |

| Geauga | 93,657 | 2.6% | 225 | 4.5% | 0.57 |

| Lake | 229,755 | 6.3% | 229 | 4.6% | 1.36 |

| Lorain | 309,134 | 8.4% | 400 | 8.0% | 1.05 |

| Mahoning | 228,452 | 6.2% | 234 | 4.7% | 1.33 |

| Medina | 179,116 | 4.9% | 800 | 16.0% | 0.30 |

| Portage | 162,476 | 4.4% | 800 | 16.0% | 0.28 |

| Stark | 371,516 | 10.1% | 412 | 8.3% | 1.22 |

| Summit | 540,810 | 14.7% | 800 | 16.0% | 0.92 |

| Trumbull | 199,144 | 5.4% | 244 | 4.9% | 1.11 |

| Wayne | 116,063 | 3.2% | 400 | 8.0% | 0.39 |

| COUNTY | POPULATION | POP. % | SAMPLE | SAMPLE % | WEIGHT |

| Medina | 179,116 | 20.3% | 800 | 33.3% | 0.61 |

| Portage | 162,476 | 18.4% | 800 | 33.3% | 0.55 |

| Summit | 540,810 | 61.3% | 800 | 33.3% | 1.84 |

Working-age Adult Focus Groups

A total of 10 working-age adult focus groups were conducted in May and June of 2020. PolicyBridge administered six in Cuyahoga County, soliciting input from a geographically balanced population in that area. To drill down deeper into the survey data, CMOR conducted four other focus groups that focused on specific subsets of the population. More details on how these sessions were conducted and who participated follows.

Cuyahoga County Focus Groups

Between May 12, and May 20, 2022, PolicyBridge conducted three focus groups on the east side of Cleveland and three on the west side of Cleveland. PolicyBridge solicited partnerships with nonprofit organizations, who served as hosts for the sessions, helped recruit participants and co-facilitated. The partners PolicyBridge engaged were: A Vision of Change; Environmental Health Watch; Esperanza; and Union Miles Development Corporation. The number of participants targeted for each session was 10 to 15 working-age adults. A total of 69 adults between the ages of 18 and 72 living in the city of Cleveland and surrounding suburbs participated. A demographic breakdown of all participants is included below. Participants were asked questions about their recruitment and retention experiences; wages and benefits; and their thoughts on the employment climate.

Focus Groups of Specific Population Subsets

CMOR conducted three, 90-minute focus groups from May 18 to June 27, 2022, to collect qualitative data and information specific to certain subsets of the population. Individuals who participated in the working-age adult survey were recruited for the focus group sessions, based on their survey responses. The sessions focused on: individuals working in the hospitality industry; individuals who plan to quit this year; and individuals who work more than one job.

Regional Workforce Analysis

The change in jobs estimate was derived from the US Census Bureau Quarterly Workforce Indicators Beginning of Quarter Employment: Counts (Yearly averages) using the 11-county geography covered in the working-age adult survey.

Northeast Ohio Industry Data

Industry Data: Lightcast industry data have various sources depending on the class of worker. (1) For QCEW Employees, Lightcast primarily uses the QCEW (Quarterly Census of Employment and Wages), with supplemental estimates from County Business Patterns. (2) Non-QCEW employees data are based on a number of sources including QCEW, Current Employment Statistics, County Business Patterns, BEA State and Local Personal Income reports, the National Industry-Occupation Employment Matrix (NIOEM), the American Community Survey, and Railroad Retirement Board statistics. (3) Self-Employed and Extended Proprietor classes of worker data are primarily based on the American Community Survey, Nonemployer Statistics, and BEA State and Local Personal Income Reports. Projections for QCEW and Non-QCEW Employees are informed by NIOEM and long-term industry projections published by individual states.

State Data Sources

This report uses state data from the following agencies: Ohio Department of Job and Family Services

Request Data

To request source analysis and raw data, please complete the form below or contact watw@thefundneo.org with the details of your request.